NYK forecasts net profit of ¥210 billion for FY 2025 日本郵船、純利益2100億円見通し 26年3月期

down ¥30 billion from previous outlook — maintains robust shareholder returns with 45 % payout ratio

当初予想比300億円減 配当性向45%で株主還元を継続

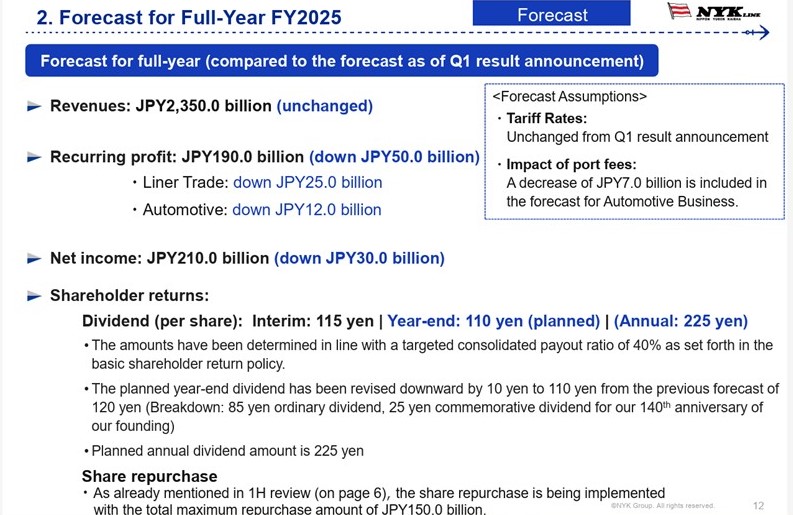

Nippon Yusen Kabushiki Kaisha (NYK) announced on 6 November that it had revised its consolidated net profit forecast for the fiscal year ending March 2026 to ¥210 billion. Although this represents a ¥30 billion decrease from the previous projection released on 5 August, due mainly to weak freight rates in the container shipping segment, the company will still maintain profits at a high level above ¥200 billion.

Key Points of the Announcement

→ NYK has set a target consolidated dividend payout ratio of 40 % for the current fiscal year. In its latest dividend forecast, it lowered the full-year dividend to ¥225 per share (from the previous estimate of ¥235), but raised the actual payout ratio to 45 – 46 %, allocating more earnings to shareholder returns.

→ At the earnings briefing, President Takaya Soga remarked, “Following the U.S.–China summit, the port entry fees on Chinese-built vessels have been postponed for one year. The same measure applies to car carriers as well; if the delay is implemented, approximately ¥7 billion in costs will not be incurred, and the automobile shipping segment is likely to be revised upward.” His comment hinted at a possible upside revision to full-year earnings.

“You can read the rest of the article in both English and Japanese.”

※ The full article includes a transcript of the online press conference featuring President Takaya Soga and Executive Officer Takashi Yamamoto, covering NYK’s dividend policy and business strategy, the latest developments on port charges after the U.S.–China summit, and expectations for support to Japan’s shipbuilding industry.

日本郵船、純利益2100億円見通し 26年3月期 当初予想比300億円減 配当性向45%で株主還元を継続

日本郵船は11月6日、2026年3月期の連結純利益予想を2100億円に修正すると発表した。コンテナ船事業の運賃低迷で前回予想(8月5日発表)から300億円減少するが、引き続き2000億円台の高水準を維持する。

この記事のポイント

→日本郵船は今期の連結配当性向の目安を40%に設定。同日発表した配当予想では通期配当を1株当たり225円(前回予想235円)としたが、純利益に対する配当性向を45~46%に引き上げ株主還元に充てる。

→決算会見に出席した曽我貴也(Takaya Soga)社長は「米中首脳会談で、中国造船船に対する入港税が1年間延期された。自動車船も同様の措置が取られ、延期されれば70億円の費用は発生せず、自動車船の業績は上方修正の方向に動く」との通期業績の上振れに含みを持たせた。

“You can read the rest of the article in both English and Japanese.”(続きは英語と日本語で書かれた本文でお読みください)

※本文ではオンライン会見に出席した曽我社長、山本敬志執行役員)Takashi Yamamoto Executive Officer)の「日本郵船の配当政策と事業戦略」「米中首脳会談後の入港手数料の動向」「日本造船支援への期待感」などの質疑応答が再録されています。

コメント