Emerging Regional Banks Find Opportunity in Overseas S&LB Deals 新興地銀、海外S&LB案件に活路

Emerging Regional Banks Find Opportunity in Overseas S&LB Deals. Secondhand Ship Prices Remain High, Loan Expansion Underway.

新興地銀、海外S&LB案件に活路。中古船価格高止まり、融資拡大で。

Japan’s emerging regional banks, which have entered ship financing in the past few years, are seeking opportunity in financing sale-and-leaseback (S&LB) deals in which they purchase vessels owned by foreign shipping companies and then enter into a new charter agreement with the same shipping company.

Traditional regional banks and Japanese shipowners, with long histories in ship finance,

(Please read the full article for the rest of the text.)

Key Points of the Article:

→ Traditional regional banks are showing a cautious stance toward current S&LB deals, as the outlook for the tramp shipping market remains uncertain while secondhand ship prices stay high. They are concerned about the “redelivery risk caused by a shortage of charterers.”

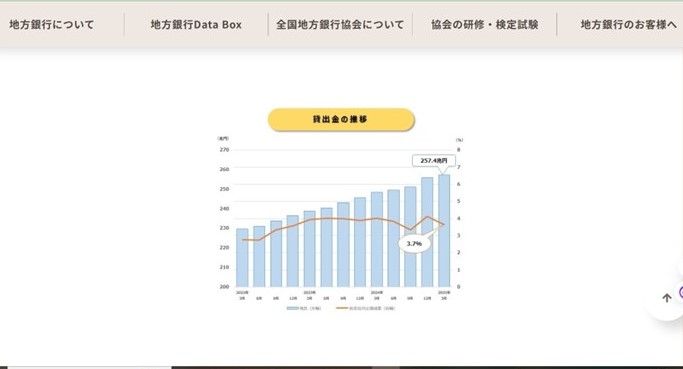

→ In contrast, emerging regional banks are considering financing for S&LB deals targeting vessels owned by foreign shipping companies. By aiming to expand their loan balances, they are exploring ways to respond to regional bank consolidation.

新興地銀、海外S&LB案件に活路。中古船価格高止まり、融資拡大で。

船舶融資にここ数年で参入した日本の新興地銀が、海外船社の保有船を購入し、再び同じ海運会社と再用船契約を結ぶセール&リースバック(S&LB)案件への融資に活路を見出そうとしている。船舶ファイナンスに長い歴史を持つ既存の地方銀行や日本船主は、(続きは本文をお読みください)

この記事のポイント

→伝統的な地方銀行は不定期船市況の先行きが不透明な一方で中古船価格が高水準を維持しているため、「用船者の不足に伴う返船リスク」を懸念し、足元のS&LB案件への融資には慎重な姿勢を見せている。

→これに対し、新興地銀は海外船社の保有船を対象としたS&LB案件に対して融資を検討、融資残高の拡大を図ることで、地銀再編への対応を模索している。

コメント